This is the third blog post in our four-part series on impact investing. Earlier, we shared what is impact investing and the reasons to undertake impact investing.

In this blog post, we will explore the challenges that are hindering entities from participating in impact investing.

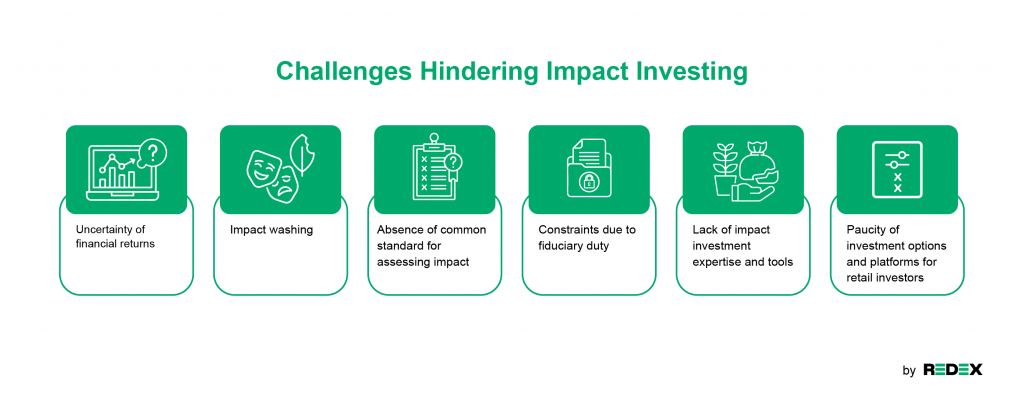

Challenges Hindering Impact Investing

Despite vast support for sustainable development and strong demand for impact investments, the market is yet to fulfil its potential as several challenges are hampering its development. The International Finance Corporation (IFC) identified the challenges as follows:

- Uncertainty of financial returns1

During the infancy of impact investing, investors were less concerned with financial returns. However, as the market grew, new potential investors were also more focused on commercial returns. The potential market is thus discouraged by the belief that impact investments pay sub-par returns. - Absence of common standard for assessing impact

The lack of common yardsticks for measuring impact made it challenging for investors to make informed investment decisions across projects and allocate funds. This is unlike financial return, which has common accounting standards and practices. - Constraints due to fiduciary duty

Investors, especially institutional, may be constrained by fiduciary duty which is often consigned to maximizing financial returns. While fiduciary duty is important in protecting capital from reckless or underperforming investment, it potentially discourages investors from considering impact goals. - Lack of impact investment expertise and tools

Impact investment is relatively new and hence, may face a shortage of expertise and talent, which is exacerbated by a lack of impact investment specific tools and frameworks. - Paucity of investment options and platforms for retail investors

Now, the bulk of impact investments are made by institutional investors who have the means and resources to conduct due diligence, measure and assess risk and provide capital. Retail investors are left out of the pie due to the absence of suitable products and challenges in accessing this type of investment.

The impact investment market has huge potential for growth. However, there are challenges hindering it from fulfilling its potential, including uncertain financial returns, an absence of common impact assessment standards, fiduciary duty constraints on investment managers, lack of impact investment talent and tools, and the paucity of investment options and platforms for retail investors.

To support the growth of the impact investing market, REDEX developed Impact Marketplace to make impact investing accessible to more investors. We seek to resolve the some of the pain points of impact investing experienced by investors and facilitate the use of renewable energy at the same time. Discover more about Impact RECs and their benefits at Impact Marketplace. Make an impact today!

In the last of our four-part series on RECs, we will share more about the potential strategies to enhance the current impact investment ecosystem.

1 International Finance Corporate, “Creating Impact: The Promise of Impact Investing”, 31