This is the fourth and final blog post in our four-part series on impact investing. Previously, we shared what is impact investing, the reasons to undertake impact investing, and the challenges hindering the growth of impact investing.

In this blog post, we will highlight some of the potential solutions to resolve the challenges affecting the development of the impact investing market.

Potential Solutions to Challenges

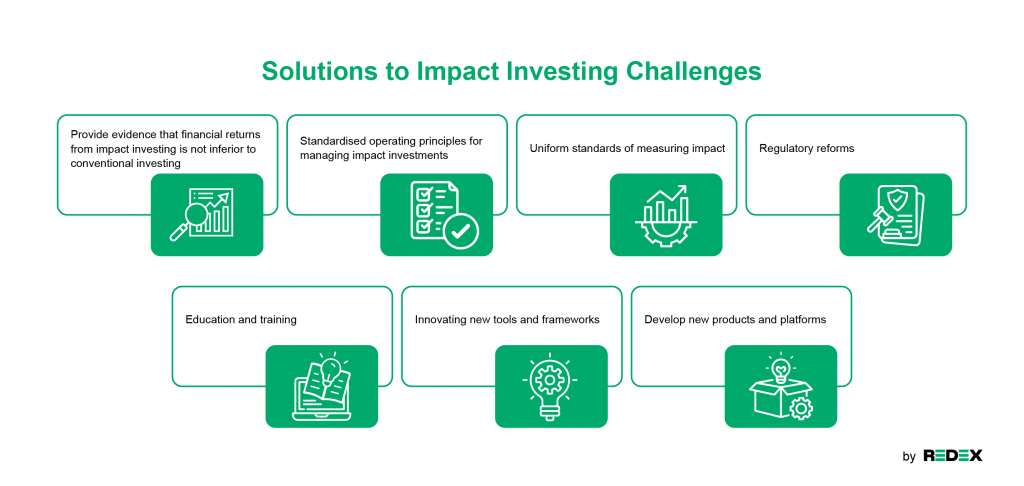

The issues surrounding impact investing include uncertain financial returns, impact washing, an absence of common impact assessment standards, fiduciary duty constraints on investment managers, lack of impact investment talent and tools, and the paucity of investment options and platforms for retail investors.

Potential solutions proposed by the IFC1 and GIIN2 include:

- Provide evidence that financial returns from impact investing is not inferior to conventional investing

According a 2017 study by GIIN, impact investors who seek market returns can achieve them3. Their analysis reveals that impact investment funds performed similarly to conventional funds. Another similarity between both types was that the choice of fund manager was crucial in determining returns. - Standardised operating principles for managing impact investments

With standardised operating principles, stakeholders will have a common understanding of the key aspects of how to integrate impact considerations with financial returns during the investment process. A common standard is likely to result in greater transparency in the investments, build trust in the market, and help investors to identify the funds, institutions, and asset managers that pursue impact in a disciplined way. - Uniform standards of measuring impact

Increased transparency is fostered by adopting and utilising a uniform standard for measuring frameworks and tools for impact investments. Impact reporting is thus strengthened, enabling the industry to gain mainstream acceptance and attract more capital. With greater transparency and rigorous standards of measurement, the likelihood impact washing is also reduced. - Regulatory reforms

Regulatory reforms pertaining to investment policy, and rules related to disclosure and reporting could potentially enable investment managers to consider impact goals in addition to financial returns, while protecting fiduciary duty. Furthermore, to spur investment, tax incentives could be given for impact investments. - Education and training

As the impact investment market grows, the need for talent with expertise in this area will grow significantly. To prevent bottlenecks arising from talent shortages that curb growth, tertiary institutions, training institutes and professional organisations should start developing a talent pipeline for impact investment. - Innovating new tools and frameworks

Modern investment analysis tools primarily focus on financial returns. There is a need for these tools and frameworks to be updated by incorporating impact performance as well. - Develop new products and platforms

To tap the retail market, new products and platforms must be developed, providing ease of entry for retail investors. In recent years, the explosive growth of digital technology has accelerated the development of fintech and democratisation of data4. Riding on this wave of development, new financial products and platforms have sprouted, providing opportunities for investors previously unavailable. For instance, REDEX developed Asia’s leading trading platform for renewable energy certificates (RECs).

Committed to innovation, REDEX is continuously developing new products and enhancing current solutions. To address some of the challenges of impact investing, REDEX has developed Impact Marketplace which enables trading of Impact RECs issued from Impact Projects.

Impact Marketplace bridges communities and investors dedicated to fostering sustainable development. It allows businesses to fulfil their environmental commitments while also supporting communities that lack essential resources. The sale of Impact RECs on Impact Marketplace enables impact investors to earn a return on their investment in building distributed renewable energy assets while offering potential REC buyers the opportunity to reduce their carbon footprint and contribute to sustainable development at the same time.

Join the global transition to net zero and enhance your corporate sustainability credentials on Impact Marketplace. Contact us to find out more and to make an impact today!

1 International Finance Corporate, “Creating Impact: The Promise of Impact Investing”, 31-63

2 Global Impact Investing Network, “Roadmap for the Future of Impact Investing: Reshaping Financial Markets”, 38-66

3 Muduliar & Bass, “GIIN Perspectives: Evidence on the Financial Performance of Impact Investments”, 26

4 Global Impact Investing Network, “Roadmap for the Future of Impact Investing: Reshaping Financial Markets”, 21