This is the second blog post in our four-part series on impact investing. Read the first blog post on impact investing here.

In this article, we will be analysing the reasons for impact investing, including market demand for it.

Why make impact investments?

Traditionally, market investments are seen as distinct from social and environmental causes. The former is concerned with financial returns while the latter supports social and environmental goals and are funded by philanthropic donations without the expectation of financial returns.

Impact investing, however, offers opportunities for investors to invest in projects and causes that not only support social and environmental goals, but also earn financial returns. It allows corporates to make holistic use of capital – to advance sustainable development and make a positive difference to their stakeholders while reaping reputational and economic benefits at the same time.

Market and Demand for Impact Investing

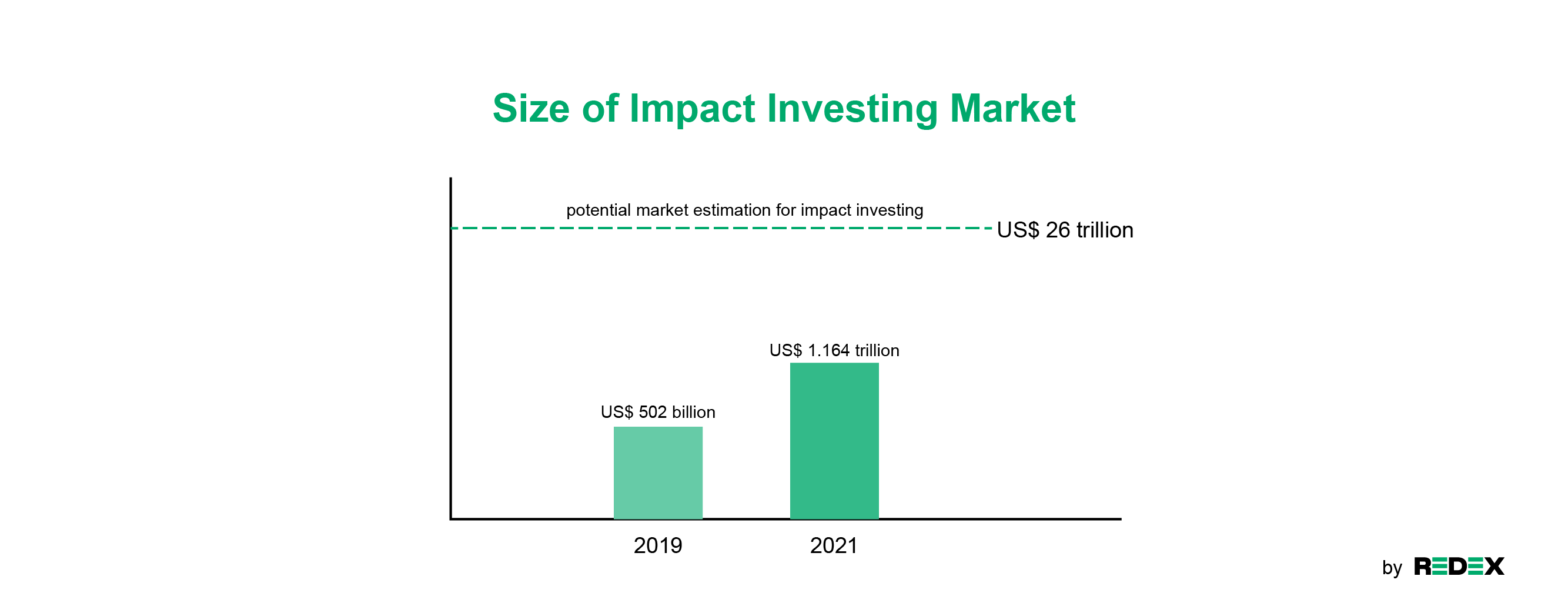

According to an estimate by the Global Impact Investing Network (GIIN), an international think tank on impact investing, the assets under management (AUM) of the impact investing market grew by more than 100%, increasing in value to USD1.164 trillion1 in 2021 from USD502 billion2 in 2019.

However, this is just a fraction of the market potential and there is still room for growth. The International Finance Corporation estimates that the potential market for impact investing could be worth as much as USD26 trillion3.

Due to growing awareness of the need to address social and environmental challenges, impact investing has gradually entered the mainstream. It is not unusual for businesses to actively invest in initiatives that tackle sustainability-related challenges not just for financial, but for holistic returns. In an article published in 2022, Forbes shared that “over 50% of active impact investing organizations made their first investment in the past decade4”.

A 2020 survey by GIIN indicated that 85 percent of asset managers made impact investments due to client demand5. This was backed up in a 2022 study by Bank of America which suggests that demand for sustainable or impact investing is driven especially by younger people, with 73 percent of those aged 21-42 holding sustainable investments as part of their portfolio6. This was nearly double the rate of 37 percent in 2018. Thus, with appropriate tools and platforms in place, private investors can potentially be major financers of the transition to a sustainable economy.

The increasing emphasis on social and environmental factors in investing connotes a broader transition in the global financial markets — an increasing number of people are cognisant that their funds should be used in a way that transcends monetary gains. Their investments may spark sustainable development that benefits the disadvantaged and the world-at-large, in line with the United Nations (UN) Sustainable Development Goals (SDGs).

As elaborated, the demand for impact investing has grown and is still growing with the estimated market potential reaching more than a USD1 trillion. Impact investments not only allow corporates to not only “do good” but also earn potential financial returns.

At REDEX, we have curated Impact RECs from Impact Projects for purchase on Impact Marketplace. There are several types of Impact Projects. Some aim to install distributed renewable energy assets in areas not connected to the grid and provide the underprivileged with access to electrical power; other projects see renewable energy assets generating electricity for sale to the grid, earning income that is channeled to community uplifting and sustainable development. Project investors may list Impact RECs for sale while buyers may offtake Impact RECs to reduce their Scope 2 emissions and boost their sustainability credentials. Contact us to learn more about Impact RECs that can fulfil your sustainability and corporate social responsibility goals. Make an impact today!

In our next blog post, we will provide an overview of the challenges hindering impact investing.

1 Global Impact Investment Network, “What You Need to Know About Impact Investing”

2 Global Impact Investment Network, “Sizing the Impact Investment Market”, 6

3 International Finance Corporate, “Creating Impact: The Promise of Impact Investing”, vii

4 Laker, “Demand For Impact Investing Is Rising. Here’s Why”

5 Hand et al., “2020 Annual Impact Investor Survey”, 20

6 Bank of America, “Starkly shifting attitudes amid a historic wealth transfer”